We Strive To Get You The Most Competitive Rates

Hometown Equity Mortgage engages in the business of originating, closing and funding residential loans throughout America. Our goal is to do everything in our power to enhance our borrower’s journey of success* through the mortgage loan process.

Click Here for Rates Calculator

Here’s a list of the types of mortgages we offer:

- Conventional Mortgages

- First Time Home Buyers

- FHA

- Veterans

- Jumbo Loans

- Mortgage Refinancing

- Debt Consolidation

- Cash Out Your Mortgage

- USDA / Rural

*Certain restrictions & credit approval apply; not all applicants will qualify.

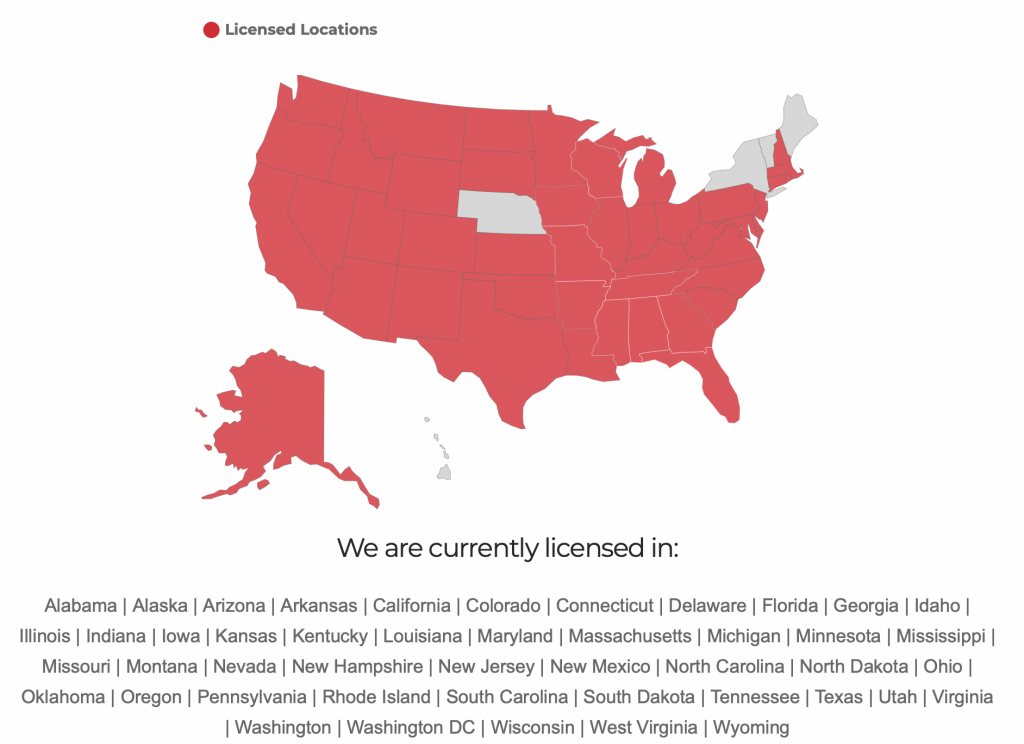

Now Licensed in 46 States Nationwide!

We’re licensed to serve you in 46 states throughout America, with more being added monthly! Click here so see if we’re in your state!